utah county sales tax calculator

The 2018 United States Supreme Court decision in South Dakota v. Utah has a higher state sales tax than 538 of.

Sales Tax On Grocery Items Taxjar

As far as all cities towns and locations go the place with the highest sales tax rate is Ogden and the place with the lowest sales tax rate is Eden.

. Heres how Utah Countys maximum sales tax rate of 725 compares to other counties around the United States. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 749 in Salt Lake County Utah. The current total local sales tax rate in Utah County UT is 7150.

Utah State Sales Tax. The most populous zip code in Weber County Utah is 84404. 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006.

Find your Utah combined state and local tax rate. State Local Option. There are a total of 131 local tax jurisdictions across the state collecting an average local tax of 2108.

The Utah County Sales Tax is collected by the merchant on all qualifying sales made within Utah. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. The Utah County sales tax rate is.

Average Local State Sales Tax. All numbers are rounded in the normal fashion. Census Bureau American Community Survey 2006-2010.

Just enter the five-digit zip code of the location in which the. The most populous zip code in Cache County Utah is 84321. Sales Tax Rate s c l sr.

Please use the options below to search for your tax rates by district or year. The December 2020 total local sales tax rate was also 7150. The Utah County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Utah County Utah in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Utah County Utah.

The minimum combined 2022 sales tax rate for Utah County Utah is. So whilst the Sales Tax Rate in Utah is 595 you can actually pay anywhere between 595 and 86 depending on the local sales tax rate applied in the municipality. A county-wide sales tax rate of 08 is applicable to localities in Utah County in addition to the 485 Utah sales tax.

Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. Washington County Sales Tax Rates for 2022. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

-- Select One -- ALPINE CITY ALPINE SCHOOL DIST SA 6-7-8 ALPINE SCHOOL DIST SA 6-8. Sr Special Sales Tax Rate. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov.

You can find more tax rates and allowances for Washington County and Utah in the 2022 Utah Tax Tables. According to Sales Tax States 61 of Utahs 255 cities or 23922 percent charge. Maximum Local Sales Tax.

Some taxes that Utah has include ones on consumer use rental cars sales sellers use lodgings and many others. The various taxes and fees assessed by the DMV include but are. This is the total of state and county sales tax rates.

The average cumulative sales tax rate between all of them is 687. You can find more tax rates and allowances for Utah County and Utah in the 2022 Utah Tax Tables. The most populous location in Cache County Utah is Logan.

91 rows This page lists the various sales use tax rates effective throughout Utah. The average cumulative sales tax rate between all of them is 726. Washington County in Utah has a tax rate of 605 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Washington County totaling 01.

Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here. If you need access to a database of all Utah local sales tax rates visit the sales tax data page.

Utah sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Thats why we came up with this handy Utah sales tax calculator. Some cities and local governments in Utah County collect additional local sales taxes which can be as high as 16.

The most populous location in Weber County Utah is Ogden. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. Utah UT Sales Tax Rates by City all The state sales tax rate in Utah is 4850.

You can use our Utah Sales Tax Calculator to look up sales tax rates in Utah by address zip code. The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local sales tax consists of a 180 county sales tax and a 025 special district sales tax used to fund transportation districts local attractions etc. Maximum Possible Sales Tax.

What is the sales tax rate in Utah County. 2022 Utah Sales Tax By County Utah has 340 cities. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

As far as all cities towns and locations go the place with the highest sales tax rate is Hyrum and the place with the lowest sales tax rate is Cache Junction. Select the Utah county from the list below to. ICalculator US Excellent Free Online Calculators for Personal and Business use.

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Utah County in Utah has a tax rate of 675 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Utah County totaling 08. Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities.

S Utah State Sales Tax Rate 595 c County Sales Tax Rate. Sales Tax Chart For Salt Lake County Utah. To calculate the sales tax amount for all other values use our sales tax calculator above.

Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Average Sales Tax With Local. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. The Utah state sales tax rate is currently.

Or visit our Utah sales tax calculator to lookup local rates by zip code. Search by District. Utah has recent rate changes Thu Jul 01 2021.

L Local Sales Tax Rate. Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

274 rows Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax. US Sales Tax Rates UT Rates Sales Tax Calculator Sales Tax Table. With local taxes the total sales tax rate is between 6100 and 9050.

How To Charge Your Customers The Correct Sales Tax Rates

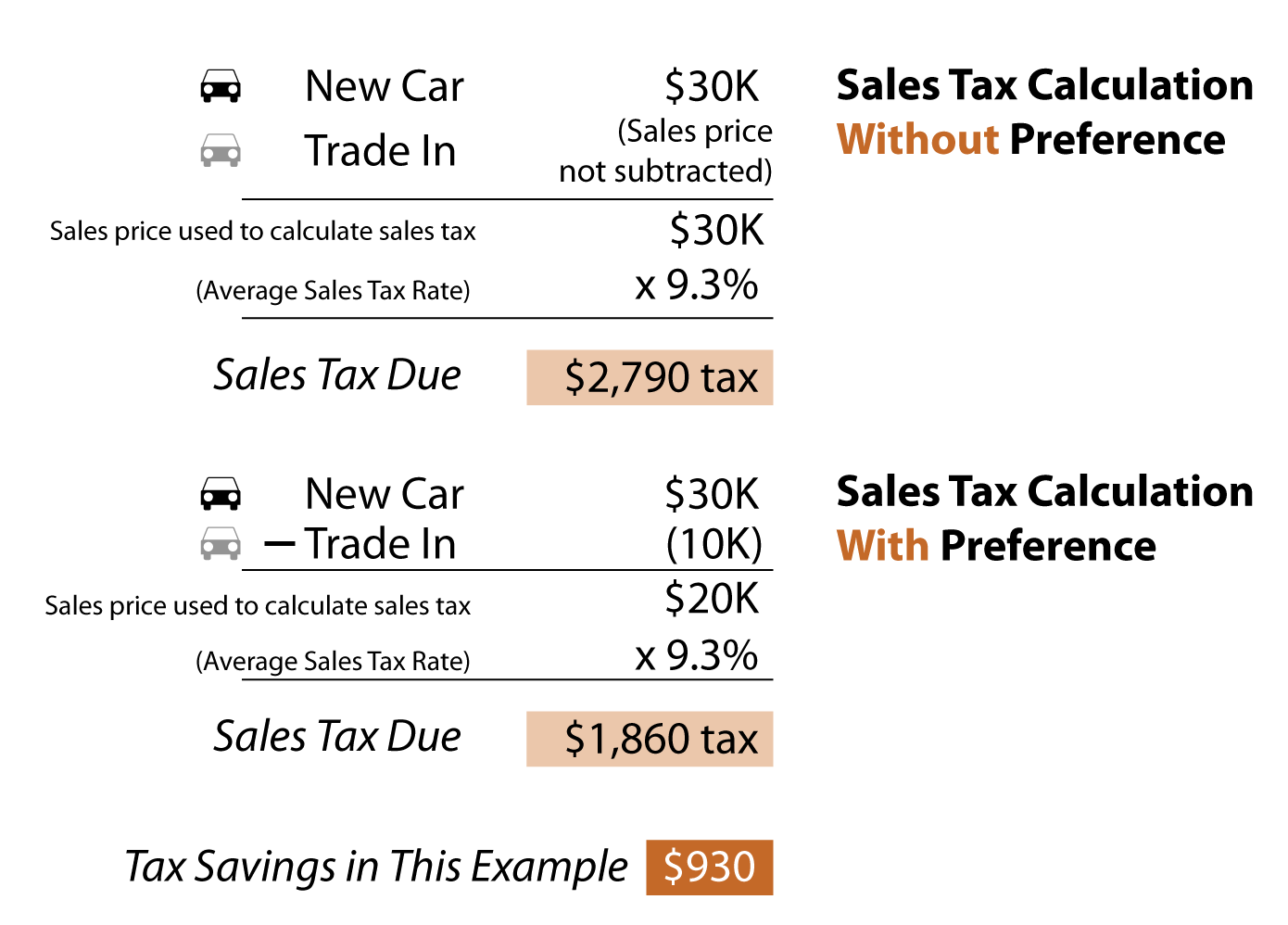

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Utah Sales Tax Small Business Guide Truic

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

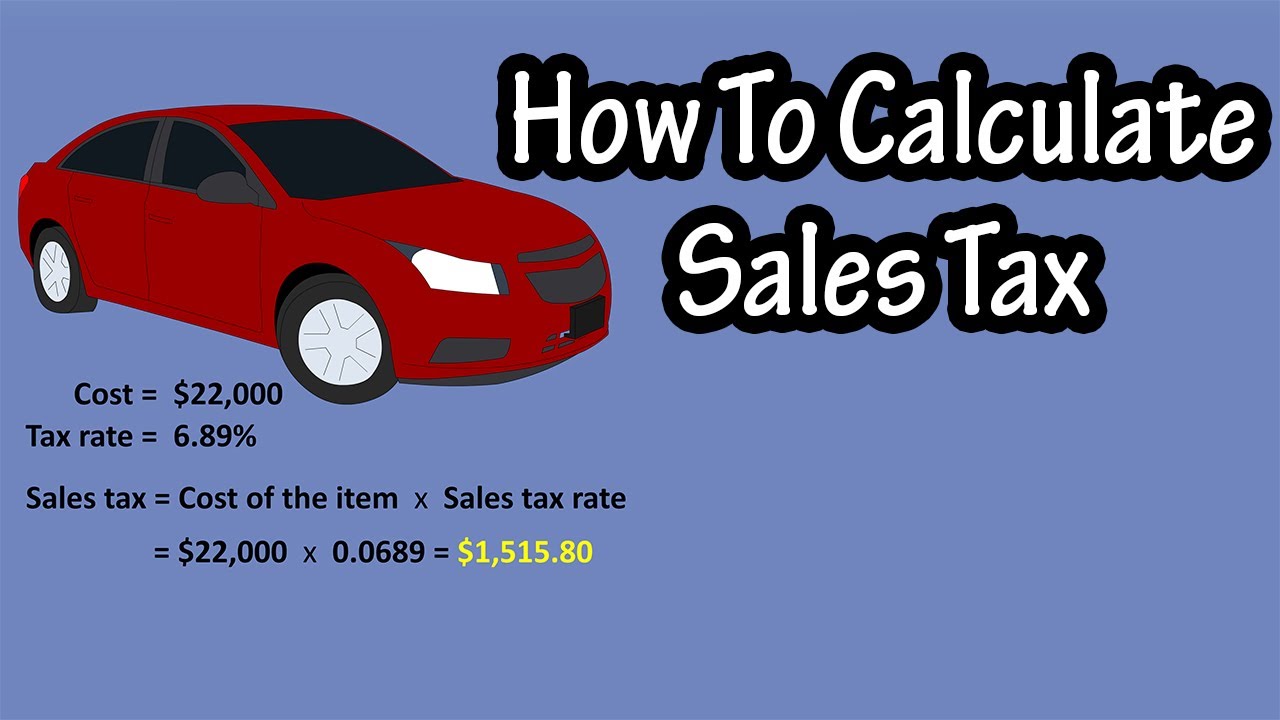

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

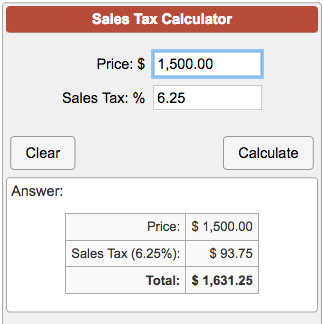

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Sales Tax Calculator Credit Karma

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com